With many of these schemes offering the customer the choice to delay cost with out paying curiosity, they don’t seem to be seen by legislation in the same method as other similar financial products. Many shopping apps and even digital banks like Monzo now offer BNPL options, promising to “make on-line purchasing easy” with “effortless and protected” short-term financing. It’s curiosity free borrowing, so there isn’t any added payment to the worth of your purchases, and there aren’t any onerous credit score checks to be eligible. Items bought with Klarna comply with our normal return process. Please observe, refunds for Klarna purchases will be refunded from Yours Clothing to Klarna. When the refund is processed, any upcoming payments you want to Klarna will be cancelled and any payments you may have already made shall be refunded back to the cardboard you paid with.

I’m anti-debt and anti-lending, however I do respect that you do still have to construct your credit file, and there are still good ways to attempt this. It’s that question of; How a lot do I really want to buy this if it needs to be placed on ‘purchase now, pay later’? Your family and friends will all the time perceive if you presumably can’t afford to purchase them a gift. But nevertheless long you set it off, there all the time comes a point the place the funds are due, so that you’re simply delaying the inevitable. It can be, when used sensibly, nevertheless it’s also very easy to get caught in a money mess.

Zip It Faster In The App!

Find out whether or not clients suppose Missguided is any good and what the brand’s different insurance policies are. Find out whether or not prospects assume ASOS is any good and what the brand’s completely different policies are. Find out whether prospects think PrettyLittleThing is any good and what the brand’s different insurance policies are.

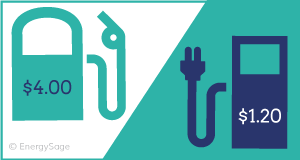

Can you use Zilch to pay bills?

BNPL firm Zilch is among the corporations offering instalment options for energy payments payments over a six-week interval.

In 2018, Swedish fashion large H&M Group invested $20m (£14.4m) to purchase a stake of less than 1%, and they are now working on a worldwide roll-out across all H&M fascias. Danish model house Bestseller is another investor, as is US department store chain Macy’s, and rap legend Snoop Dogg, who has fronted a number of Klarna campaigns. However, the picture seemed very completely different when taking a glance at BNPL customers in isolation. 67% of US BNPL users and 60% of UK BNPL users stated that it helps young folks afford things they want or want. Young people who had used BNPL services had been, on stability, much less concerned about moving into debt.

Best Autumn Attire 2022

With their Gen Z friendly language and social media marketing, BNPL merchandise don’t appear to be finance schemes. However, they’re merely a form of credit and don’t come free from threat. Pay in 4, curiosity free at 100s of stores and manage your orders, repayments and refunds all in our app.

Like ‘trend hauls’, where individuals make large orders of garments to strive on and ship again what they do not need later, instead of ordering just the one item they want. We chat to blogger, Instagrammer and Words that Count ambassador Thrifty Clair, on the pros and cons of ‘buy now, pay later’, and why this engaging payment option could be a double edged sword when not used responsibly. Used by all the big fast fashion players – together with the Boohoo Group, Arcadia and ASOS – these BNPL schemes arguably reinforce the concept clothes may be purchased flippantly.

What Is ‘Buy Now, Pay Later’? Thrifty Clair Explains

Pay later in three will let you spread the worth of your buy over 3 equal funds. The cost for every instalment will mechanically be collected from the debit or bank card you entered at checkout. Your first instalment shall be collected when your order is confirmed by Yours Clothing and instalments 2 and three are scheduled 30 and 60 days later, respectively. Nevertheless, the speedy growth of buy now, pay later has not come with out criticism. However, Klarna’s average consumer is aged 33, and its fastest-growing demographic is Generation X (40-to-54-year-olds) switching from conventional credit cards to purchase now, pay later options. Lots of those products are not regulated in the identical means bank cards are,” she explained.

We’re excited to supply our customers new ways to pay at checkout with our fee companion Klarna. Klarna present smooth payment processes to over 200,000 retailers worldwide and greater than ninety million consumers are using Klarna as their most well-liked cost sort. But what BNPL is not good for is deferring fee on insignificant objects and placing yourself into debt with fast trend sites like Boohoo and Pretty Little Thing, or on a regular basis online purchasing.

Because of the shiny method BNPL is marketed, it does not feel like debt, but that’s primarily what it’s. Become a member — don’t miss out on offers, offers, reductions and bonus vouchers. By activating Pay later your personal information shall be shared with Klarna Bank AB (Publ.) for credit evaluation purposes. All transactions take place through connections secured with the newest industry standard safety protocols. Klarna is exclusive and offers Pay later in 3 based on a selection of components such because the order value, previous order history and merchandise availability.